Living Through Giving

December 2022

Dear friends,

We are just a few weeks away from the close of 2022. What a perfect time to reflect on all the Community Foundation has been able to accomplish to help local nonprofits.

Here are just a few of our successes from the past twelve months:

- Provided grant writing & grant research services to over 100 nonprofits.

- Partnered with the City of Ocala and Marion County, respectively, to distribute more than $2.5 million to nonprofits in funding via the American Rescue Plan Act.

- Delivered over 6,000 backpacks to Marion County students through the Back-to-School Community Giveback program.

- Launched our inaugural “Lead Like a Mastermind” nonprofit leadership course to encourage nonprofit executives to continue to invest in themselves and their team.

- Assisted local nonprofits in raising more than $771,000 in 33 hours with our Give4Marion campaign.

In this edition of our quarterly Living Through Giving eNewsletter, you’ll read more about what the Community Foundation is doing as we wrap-up this year and prepare for 2023. Contact me to learn more about how you can be involved in the new year.

Sincerely,

Lauren Deiorio, President/CEO

NonProfit Business Council Christmas Social

On December 7th, the NonProfit Business Council held its annual Christmas social at the Brick City Center for the Arts!

This year’s celebration had a special arts theme, with a cookie decorating contest and special painting made by the entire group.

Among the giveaways were an 85-inch flat screen TV and cases of beer and wine.

Special thanks to Marion Cultural Alliance for hosting at their location.

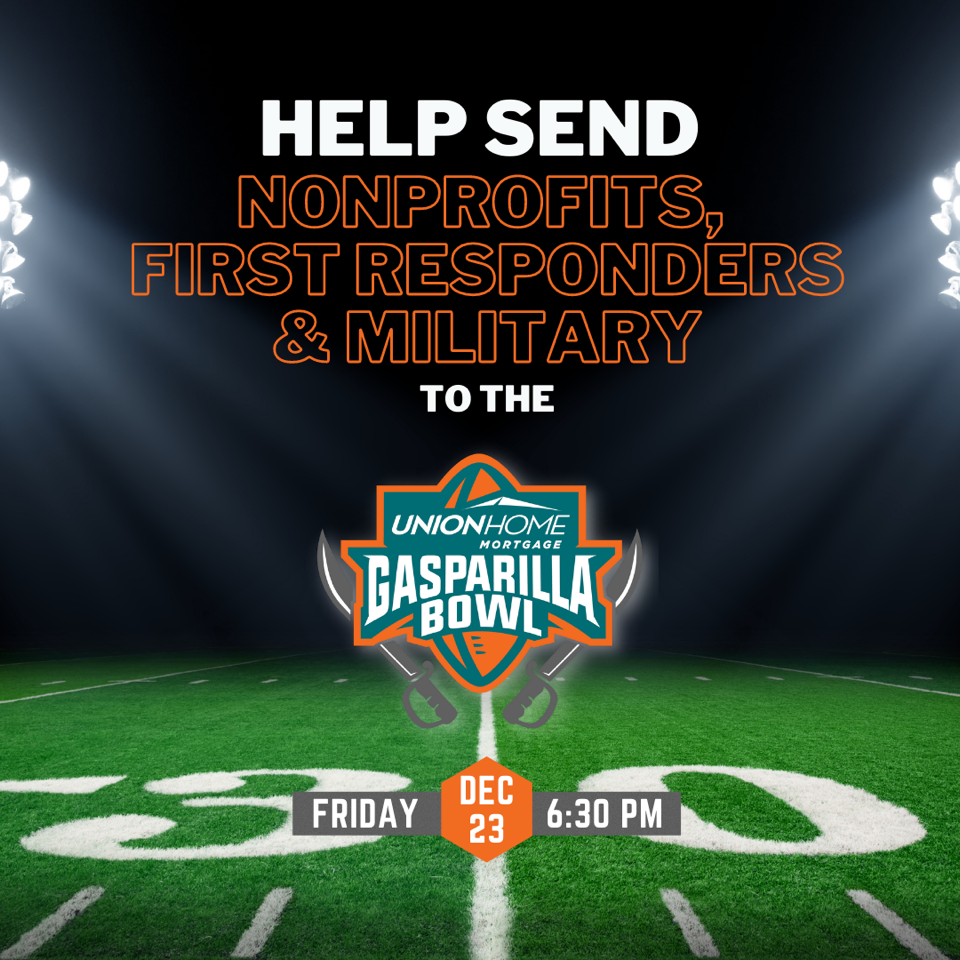

Gasparilla Bowl Gives Back Fund

The Community Foundation for Ocala/Marion County has partnered with ESPN Events and the Union Home Mortgage Gasparilla Bowl to create the Gasparilla Bowl Gives Back Fund. This fund will go to purchase tickets to this year’s Gasparilla Bowl game between Wake Forest and Missouri for first responders, active/retired military, teachers, and nonprofits.

Donations from individuals and businesses are tax-deductible for above the line filers and perfect for end-of-year charitable gifts.

Click here to the view the donation portal.

For tickets, download the application our website at https://www.ocalafoundation.org/gasparilla-bowl-gives-back/ and email ashley@ocalafoundation.org with the completed form.

Angelica G. Muns Nursing Scholarship

The Community Foundation is currently accepting applications for the Angelica G. Muns Nursing Scholarship through Tuesday, January 10th.

Twice a year, the Angelica G. Muns Nursing Scholarship Fund awards scholarships to local nursing students, once in January and once in August.

Mrs. Muns was a United States Airforce Lt. Colonel and registered nurse who served during World War II. Her love of her service and her profession led to her desire to establish a nursing scholarship to ensure those wanting to excel in the field of nursing.

Mrs. Muns and her husband were provided excellent healthcare in Marion County and her scholarship is established for those students who plan on staying in Marion County and working at a Marion County acute healthcare facility.

Receiving students must adhere to the following criteria:

- Letter of reference from nursing clinical instructor

- A personal reference

- Must be pursing a BSN or ADN degree

- Minimum of 3.0 GPA for the duration of their nursing education

- Two-page submitted essay

- Commitment to work in a Marion County acute healthcare facility

Click Here To View The Application.

Donor Advised Funds

As this year comes to a close, consider opening a Donor Advised Fund for your charitable giving & tax needs.

A Donor Advised Fund, or “DAF”, is a flexible charitable account that enables donors to receive an immediate tax benefit for their contributions. These contributions are then invested for tax free growth until the donor is ready to recommend grants to a nonprofit agency.

Here are some the advantages to opening a DAF:

- Easy to get started- Starting a donor-advised fund is very simple. The minimum amount to open one is $5,000. To start, you only need to sign a fund agreement and send it with our money or appreciated securities.

- Simplified recordkeeping- We make it easy to grant from your fund. You recommend a grant to a nonprofit and we handle the rest.

- Avoid capital gains taxes on appreciated securities- You can donate your appreciated asset to your fund, avoid the capital gains taxes and receive the market value for your donation to the fund.

- Modest fees- We charge an annual management fee of 1% or less based upon the fund’s balance.

- Fund growth is tax free- All that growth in your donor-advised fund is completely tax-free (not just tax-deferred like your 401k).

- We help you find the right causes- The Community Foundation staff deals with nonprofit organizations every day at the Nonprofit Resource Center, and we are happy to supply as much (or as little) advice, guidance, assistance, support and help as is requested.

- Use the fund to make a difference in perpetuity- You can designate who should take over the responsibility of recommending future grants. You can also specify what types of charitable institutions and/or interests the Community Foundation should fund with your assets in the future.

- Ability to Distribute Funds anonymously- If you would like your contributions to be given to charities anonymously, the Community Foundation will carry out your wishes.

Interested in getting started? Contact us to learn how!

NOTE: In order to take advantage of setting up a Fund for 2022 tax planning, we must have paperwork and the initial contribution no later than December 30th. If using appreciated stock as the initial contribution, we ask that the process be started by December 20th in order to meet the year-end deadline.

In November, the NonProfit Business Council was joined by a panel of local business leaders who shared their perspective on building positive workplace culture.

Discussing both the positive and negative learned through experience, this session highlighted how nonprofit directors and staff members can become better leaders within their organization.

The NonProfit Business Council meets on the third Tuesday of every month at the Ocala Police Department’s Community Room. The first meeting of 2023 is scheduled for Tuesday, January 17th at 8:30 AM.

To learn more about the NPBC, or to register your nonprofit, click here.

The Estate Planning Council of Marion County held a special fall summit on November 9th at Golden Ocala Golf & Equestrian Club. The two workshops were led by Paul Caspersen, CFP, AEP, MS and Dr. Rahul Razdan, respectively.

Upcoming in the new year, the Estate Planning Council will meet quarterly to discuss a variety of estate-planning topics. Meetings are held quarterly on Wednesdays at noon at Fiore’s Cafe in Ocala.

The first meeting is scheduled for Wednesday, February 15th, 2023.

To join or learn more about the Estate Planning Council, click here.

Want To Become More Involved?

Contact us to learn more about how the Community Foundation can help connect your passion to purpose!

If you’re a donor, click here to see what type of charitable funds are held at the Community Foundation or about setting up your own.

Also view our Nonprofit Directory to view organizations operating in Marion County.

If you’re a nonprofit, click the links below to learn more about the Community Foundation’s free Nonprofit Resource Center and the collaborative NonProfit Business Council.

Click here to make a year-end gift to the Community Foundation and help us continue building a stronger community one passion at a time.